The Challenge

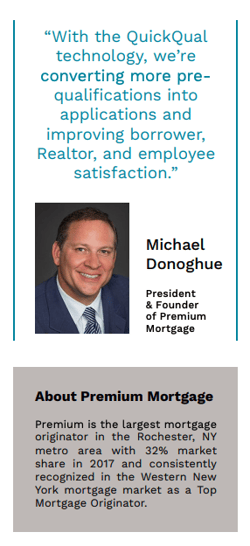

Since 1999, Premium Mortgage has swept Upstate New York—helping clients find home loans to fit their financial and future needs. As the largest mortgage originator in the Rochester, New York metro area, they held 32% market share in 2017, and consistently holds recognition as a Top Mortgage Originator in Upstate New York. Having much success, the loan team pre-qualifies multiple borrowers, multiple times a day. Michael Donoghue, President and Founder of Premium Mortgage was frustrated by the limitations of the existing pre-qualification process: providing a prospective customer with an archaic PDF document that contained static information regarding their pre-qualification. Between manual revision and hours tracking customers, the process was inefficient.

“We would have buyers losing out on deals because they couldn’t get a new pre-qualification letter when they needed it. In today’s competitive market we needed to empower our customers even more so they would stand out,” says Donoghue.

When the opportunity arose to utilize the QuickQual digital solution, Premium Mortgage tested it out for effectiveness—How will it help track and support customers? Will it help loan officers become more efficient with their time? What will the conversion rates be from pre-qual letters to applications?

The answers? Today, QuickQual is an integral component of Premium Mortgage’s year over year growth. Continuing reading to learn more.

The QuickQual Solution

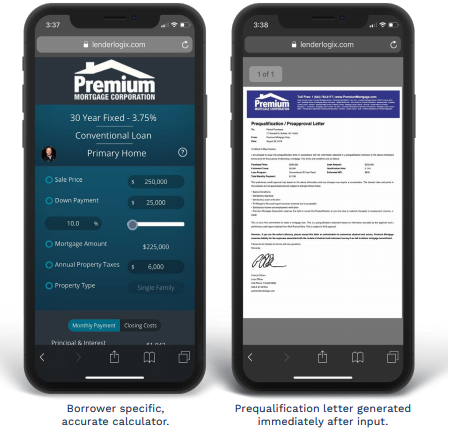

LenderLogix approached Premium Mortgage with their QuickQual technology: A digital product that works with the company’s Loan Origination System to provide the client a real-time letter (instead of a tedious PDF). Premium Mortgage knew QuickQual would make them a differentiator in the market with benefits like:

- An updated monthly payment summary

- Ability to text the letter to borrower and Real Estate Agent

- Built in closing cost calculator

- And more....

Premium Mortgage saw QuickQual empowering their borrowers and Realtors with easy-to-use technology. Customers could create as many pre-qualification letters as needed for any situation, while staying within the parameters set by the loan officer—in real time.

Best of all, the QuickQual product included analytics and data to help loan officer provide evidence-based support for borrowers. In fact, analytics from QuickQual continue to improve Premium Mortgage’s pre-qualification to mortgage application rate to over 50%.

The Results

1. Increased Pull Thru Rate

Through QuickQual, Premium Mortgage’s application rates have increased over 50%. The process is now seamless and smooth—A far cry from the past when mortgage lenders spent significant time and money pre-qualifying borrowers. Instead of being given a piece of paper in hopes to be contacted again, QuickQual does the work in real-time and helps track the client. The letters are created digitally and texted immediately.

Through data-driven statistics, QuickQual ensures that Premium Mortgage will be top of mind for the borrowers. Analytics reveal on average, borrowers login to QuickQual over 21 times while they are in the pre-qualification phase of their home buying journey—in turn creating higher conversion rates of applications.

2. Increased Realtor Referrals

Realtors choose to use QuickQual because it allows for flexibility and better responsiveness to help clients stand out in multiple offer scenarios. In fact, the satisfaction rate is so high, realtors will now refer customers to Premium Mortgage because of the ease-of-use and efficiency of QuickQual.

3. Increased Loan Officer Satisfaction

In today’s market, loan officers have become an important part of the home buying process. QuickQual helps loan officers at Premium Mortgage stand out—making them a preferred employer for top performing loan officers.

Michael Donoghue states, “If I took QuickQual away from my loan officers, I’d have a mutiny.”

Premium Mortgage is thriving from the support of QuickQual technology:

- Higher pre-qual letter to application conversion rates.

- Increased employee satisfaction.

- Increased customer satisfaction.

- Increased efficiencies between loan officers and clients.

And overall, creating a well-rounded, smooth financial process that is unbeatable in the home-buying market.