The Challenge

Premium Mortgage Corporation has served clients in New York State as one of the largest mortgage originators for over 20 years. They consistently hold recognition as a Top Mortgage Originator in Upstate New York and are dedicated to finding home loans to fit their client’s financial needs.

In 2019, Premium Mortgage Corporation realized they had a problem with uncollected fees. While their application-to-closing pull-through rate was a strong 90%, they only collected upfront fees (appraisal, credit report, etc) on about 80% of their loans. On the 7,500 loans they were originating annually, they didn’t collect upfront fees on 20% of those, about 1,500 loans. With average fallout of 10%, that meant Premium was absorbing those uncollected fees on the 150 that didn’t make it to closing. That amounted to over a $75,000 loss on appraisal fees alone.

There were various reasons the fees went uncollected. Often the loan officer worked out an arrangement with the borrower to collect the fees at closing, which is fine when the loan closes, but is highly problematic if the loan falls out. In other instances, loan officers would unknowingly get incorrect card numbers or deal with declines when trying to process payments. The manual processes involved in addressing these situations contributed to the 20% in uncollected fees.

Premium Mortgage chose Fee Chaser to automatically send a payment request to each borrower at application (upon receipt of “Intent to Proceed”) to collect the applicable fees on each loan. Since Fee Chaser is integrated with ICE Mortgage Technology™ Encompass®, the process is 100% automated right from within the LOS. All lenders have to do is click a button to issue their request to the borrowers - literally.

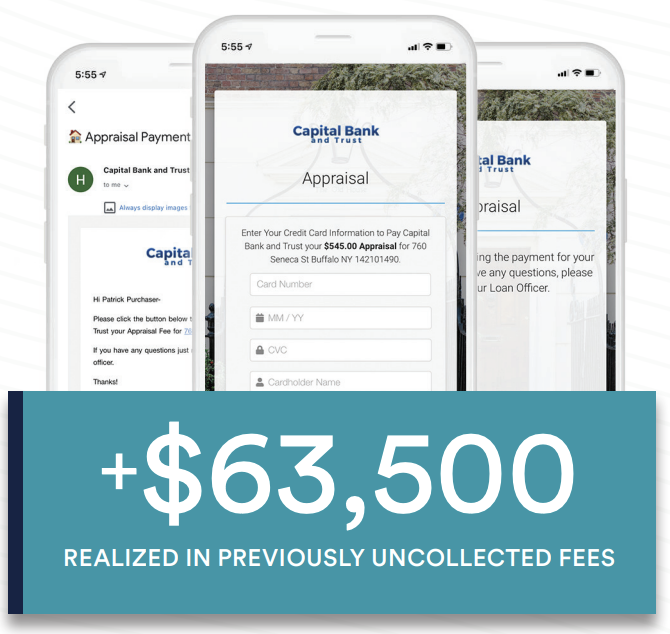

Premium Mortgage Corporation Saves Tens of Thousands of Dollars by Automating Upfront Fee Collection with Fee Chaser by LenderLogix The borrower receives a unique payment link via SMS and/or Email. The borrower enters their credit card details, and the card is processed in real-time. When the payments are complete, Encompass® automatically updates, and a receipt is posted to the eFolder. In addition, payment confirmations are sent to all relevant parties.

Just like any other online purchase, Fee Chaser is designed to account for incorrect card information and will also alert the borrower if their transaction is declined. Suppose the payment isn’t made within 24 hours. In that case, the borrower is reminded of the outstanding payment. And after 72 hours, the loan officer and processor are notified if the payment is still unpaid.

The Results

Tens of Thousands of Dollars of Additional Fees Collected Annually

After 12 months, Premium Mortgage’s percentage of uncollected fees dropped from 20% to 3%. That means on those 7,500 loans they originate annually, only 225 loans made it past Application with uncollected fees. With a 10% fallout, Premium Mortgage has limited its losses on uncollected fees to 23 transactions, or $11,500, down from $75,000 (an 85% reduction). “We credit this success to the well-thought-out user experience that Fee Chaser provides. When we think about how tech-savvy our borrowers are these days, the adoption rate of this solution is no surprise,” says Donoghue.

Enhanced PCI Compliance & Streamlined Operations

Since Fee Chaser handles the processing of these payments, Premium Mortgage can rest assured that they are PCI compliant. No financial data is shared with or stored in their business systems during these transactions.

In addition to direct savings realized by increased collection rates, Premium Mortgage was able to save a significant amount in operational costs by automating this process. Before Fee Chaser, Premium’s operations staff was responsible for processing upfront fees. A staff member would pull a handwritten form from the scanned disclosure package, transcribe the credit card information into an online card processing terminal, then, when successful, update the information within Encompass. If the card couldn’t be processed due to incorrect information or insufficient funds, the processor would have to troubleshoot the situation by attempting to reach out to the borrower and/or loan officer.

Now, Premium’s operations staff can more efficiently process the loan and get it to underwriting because Fee Chaser handles all the fee collection tasks.